What’s The Average Cost Of Utilities?

Here’s the quick answer: The average cost of utilities is around $200 per month but can vary depending on a few factors.

Utility costs are based on factors like where you live and how much electricity you use. You can reduce your utility bills by sealing drafts, using energy-efficient appliances, and being mindful of your water and electricity usage.

How to Estimate Your Utility Bills

Whether you’re renting or buying a home, estimating your average cost of utilities is paramount to staying within your budget and living comfortably.

We recommend you set aside $200 or more each month to cover bare necessities like power, trash removal, and water and sewer bills.

Electricity alone costs people $1,475 each year on average. That’s a lot of money, and if you’re thinking about moving, it’s important to know the many factors that dictate the utility costs at your new place.

Luckily, we’re going to break it all down in this post.

A Quick Breakdown

So, where exactly does this $200 go? Here’s a quick breakdown of your average utility fees.

Average Electricity Bill: $65.33 – $88.10

Average Gas Bill: $80/month (varies from month-to-month)

Average Water Bill: $17.04 – $68.14 per month

Average Sewer Bill: $14.04 – $135.57 per month

Average Trash Bill: $12 – $20/month

Average Internet Bill: $56.60/month

**Find the best internet deals here.

Average Cable Bill $0 – $100 (depending on plan)

Average Condo Bill $50 – $1,000 per month

Average Phone Bill: $15 – $30/month

Can you afford the utilities?

You’ve found the perfect neighborhood, and double-checked that the rent/mortgage fits within your budget. But: Can you afford the utilities?

While our quick breakdown above gives you an idea of what each of the utilities may cost, the range can sometimes be huge. Let’s get into the nitty-gritty.

Ask For Prior Utility Bills

Remember, calculating in the cost of utilities is part of the move process. Figure out how much your move will cost by using a moving cost calculator.

Learn MoreThe average cost of $200 a month is only an average. One of the simplest ways of getting an idea of what the utility bills of a specific house or apartment will really be is to ask for prior utility bills. In most cases, landlords and real estate agents will provide last year’s bills if you ask them.

Requesting a copy of previous bills will also tell you which utilities were paid by the landlord and which were paid by the tenant.

Even though prior electric, water, and gas bills will vary based on usage, you’ll know with near 100 percent certainty what the trash/recycling and condo fees will cost.

Electricity – The Cost of Powering Your Home

Average Electricity Bill: $65.33 – $88.10

Almost every appliance in your home is going to be using electricity at some point in time, which is why it’s important to know exactly how you’re being charged for your power consumption.

Your electricity consumption is going to be measured in kilowatt hours (kWh), which is essentially a measure of how much power a device uses over time.

Since everyone uses different appliances at different rates, it can be pretty hard to estimate average energy usage, but here are a few constants:

Calculating Power Usage

Here’s the average cost of using some necessary household devices based on data from Duke Energy:

| Appliance | Energy Usage | Cost |

|---|---|---|

| Ceiling Fan | 0.075 kwh/hr | $0.01/hr |

| Energy Star Refrigerator | 43.0 kwh/month | $5.72/month |

| Dishwasher | 1.0 – 2.17 kwh/load | $0.13 – $0.29/load |

| Laundry (Cold Wash, Cold Rinse) | 0.3 kwh/load | $0.04 |

| Water Heater | 390 – 500 kwh/month | $51.87 – $66.50/month |

| TV (40″ – 49″ LCD) | 0.15 kwh/hr | $0.02/hr |

| Computer (Desktop) | 0.06 – 0.25 kwh/hr | $0.01 – $0.03 kwh/hr |

| Computer Monitor (17″ LCD) | 0.04 kwh/hr | $0.01 kwh/hr |

If you are renting and your landlord is billing you for utilities you are a “sub-metered tenant”. In California, there are laws that protect you so you won’t be overcharged for utilities by your landlord. If you live in San Francisco or Los Angeles you can expect to pay upwards of $222 a month on electricity alone (32% higher than the national average), so it’s important to understand how you are being billed.

Still, there’s one major factor to your electric bill that requires special consideration…

Heating and Air Conditioning – Different Variables Affect Cost

Average Heating Bill: $21.56 – $26.13 (3 – 4 months/year)

Average Air Conditioning Bill: $21.56 – $26.13 (3 – 4 months/year)

Heating and cooling usually make up 35%-40% of your energy bill.

A few things to consider when trying to estimate energy costs…

- How large is the residence? The more square footage you have the more costly it will be to maintain a certain temperature. A one bedroom apartment is going to be cheaper to heat and cool than a two bedroom apartment.

- What’s the climate like? Your air conditioning usage is going to be different in Alaska than it is in San Diego. Keep in mind the average temperatures of any potential move.

- How old are the appliances? If your HVAC system is 10 to15 years old it’s likely going to be less energy efficient than a newer unit. A survey of home inspectors listed cleaning your furnace as the home maintenance task.

- How well insulated is the home? Are windows double-pane and well-sealed? If the home is older then it likely isn’t as well insulated as a newer home.

Once you’ve figured all this out, here are some energy saving tips.

Energy Saving Tips

While many of the factors above are going to be largely out of your control, there’s plenty you can do to save energy when it comes to heating and air conditioning.

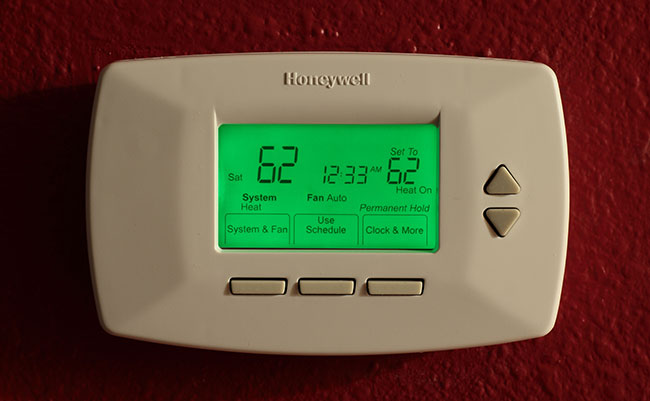

- Thermostats:

When it comes to setting the temperature in your home, keep things set as warm as you can stand in the summer and as cold as you’re comfortable with in the winter in order to keep your heat and A/C running as little as necessary. Invest in a smart thermostat that can automatically regulate the temperature for you. - Ducts:

Make sure your ducts are well-maintained, regularly checking for and sealing leaks to ensure efficient use of your heating and cooling equipment. - Fans:

Ceiling and floor fans use way less energy than air conditioning, as long as you can remember to turn them off when you leave the room. - Windows:

You can also keep your home cool by closing shutters during the day opening windows at night in the summer. Opening blinds to let the sunshine in can keep things a bit warmer in the winter too. - Filters:

You’ll want to change your furnace filter every 2 to 3 months to keep your machines running efficiently and improve the quality of air in your home. - Lighting:

Invest in energy saving light bulbs. LEDs use up to 90% less energy and last up to 25 times longer than traditional incandescent bulbs.

But what if your place hasn’t gone all-electric?

Natural Gas – It Powers Hot Things!

Average Gas Bill: $80/month (varies from month-to-month)

While electric devices are typically more common, many homes and apartments have propane or gas-powered furnaces, water heaters, and stoves.

There are many benefits of natural gas, but the main draw is the low cost compared to that of electricity.

While gas-powered devices tend to cost more upon installation and require more regular maintenance, many consider the affordability of natural gas to be a big enough draw to justify the initial hassle.

If your place does end up using natural gas or propane, you’ll probably want to learn how to read your gas bill so that you better understand exactly what you’re paying for.

Once you’ve determined whether your usage is being measured by volume (CCF or MCF) or in heat units (Therm or BTU), you can see exactly how much gas you’re using and what you pay for it.

Taking into account that the average natural gas consumption per household is 567 CFL/year and that the average price of natural gas is around $1.70/CFL, you can expect to pay close to $964.47 annually on natural gas.

Water – The Utility You Can’t Afford to Avoid

Average Water Bill: $17.04 – $68.14 per month

Unless you’re living in a house with a well or an apartment complex that adds water usage into your rent, you’ll probably be paying a monthly water bill.

It’s no secret that city water is usually expensive, but in reality you can’t avoid things like washing dishes and bathing. (Well, you could stop bathing but we really don’t recommend it). Check if what is coming out of the tap is drinking water, or if you will have to buy a filter or have drinking water delivered.

The average American’s daily water usage for one person is between 80 and 100 gallons.

A family of four using 100 gallons per person per day can expect to spend $68.14 per month on their water bill. However, if you’re living alone and using the same amount of water, your monthly water cost will be around $17.04.

Try figuring out what your monthly water consumption is before moving and learn how to read the water meter of your new home. If you are going to buy new appliances when you move, look into water efficient washing machines.

Sewer- The Cost of Sanitation

Average Sewer Bill – $14.04 – $135.57/month

There are two main reasons why your sewer bill is likely to be higher than your water bill.

The first is that the treatment of wastewater gobbles more energy than the treatment of water. Secondly, building sewer treatment infrastructure is more expensive now than it was in the past as local authorities have to meet more stringent environmental regulations.

As a result, sewer bills can vary widely across the country. In most cases, the bill is based on the average water use of a household because sewer water is not metered like a water system.The average sewer bill can be as low $14.04 in Memphis and go as high as $135.57 in Seattle.

To get an idea of how your sewer bill is arrived at, you may want to check the method used by your local authority.

Trash and Recycling – An Often Unexpected Expense

Average Trash Bill: $12 – $20/month

The monthly national average cost of waste collection is between $16 and $80.

While most cities have private companies that bill residents directly for trash collection, others factor waste disposal into local taxes.

Recycling collection can tack on around an additional $60 each year to your trash bill.

Internet – A 21st Century Necessity

Average Internet Bill: $56.60/month

Behold the internet! What was once a luxury is now a necessity.

Unfortunately, there’s a good chance you won’t have many options when it comes to internet providers in your area. Average internet service in the US is slower and more expensive than many other countries.

You can search for internet deals based on your zipcode to try and find the best deal.

The average cost of internet in the US is $56.60/month, but you can expect that to differ pretty dramatically depending on how many providers are in your area.

Phones – The Cost of Staying Connected and Secure

Average Phone Bill: $15 – $30/month

Yes, we know, landline phones are so 90’s.

Over half of the country still uses a home phone, so it’s a cost to consider.

For those who need one, you can expect to pay between $15 – $30 per month and most major cable companies will offer to include a phone line in your TV or internet package.

Cable – The Expense You Can Play Around With

Average Cable Bill: $0 – $100 (depending on plan)

Having cable TV access isn’t a necessity, but it’s definitely a quality-of-life choice that most people find to be well worth the cost.

But don’t worry about not having access to entertainment and information, because there are many great options for audio/visual content available at many price points.

Digital Antenna:

By far the cheapest option, as long as you’re within range of a local broadcaster, digital antennas allow you to watch a handful of television stations (typically including ABC, NBC, FOX, and CBS) for free.

Average Price: $0

Cable Subscription:

You’ll have fewer options depending on where you live, but all companies are required to offer basic cable packages, and bundles with internet and phone service.

Average Price: $100/month

Streaming Television:

Streaming television through the internet gives you an alternative to paying whatever their local cable company feels like charging and allows you to pick your provider.

Average Price: $25 – $40/month

Dedicated Streaming Services:

And if you’re more into watching things strictly for entertainment, there are plenty of streaming video services that offer a variety of content that appeal to almost every niche from film buffs, to classic television, comedies, and horror.

Average Price: $8 – $15/month (per service)

Condominium and Homeowner’s Association Fees

Average condo fees: $50 to $1,000 a month

Average HOA fees: $20 to $400 a month

Condominium and housing development living can give you the benefits of easy parking, a communal pool, and a gym, among other shared amenities. But it comes at the cost of monthly fees.

Your fees cover the regular maintenance of your living space and grounds. Some of the funds you pay are also invested so that they can be used for more significant projects like repainting the buildings or replacing roofs and paving.

It’s essential to be clear about what these fees cover because in some cases, they can cover utilities like water, trash, and sewer. These fees are regulated, so you can check your local state laws to see what you can be charged for.

The Effect of Roommates on Cost of Utilities

Having a roommate can help you with your housing costs, and alleviate the burden of paying for utilities on your own.

Before moving in with a roommate it’s best to have the tough conversations ahead of time.

Agree Before Moving In Together

If you can’t have an open discussion with someone, then you’re not likely to be good roommates in the first place. Good roommates are clear about their expenses and how each one will contribute to the costs and do their best to keep them low.

Write It Down

You need to have a formal agreement about your accommodation sharing arrangements and how you will pay the bills. Having an agreement in writing can help prevent arguments over things like who is responsible for which utility bills and who is responsible for taking out the recycling.

Discuss Possible Scenarios

Let’s say you met your roommate when they were single, but they fell in love during the course of your accommodation sharing arrangement. The new partner semi-moves into the apartment, but your roommate still believes their contribution should be the same as yours. This is why it’s vital to create scenarios and be clear about how you would handle them when they present themselves.

Bringing Costs Down

The $200 suggested at the beginning of this article may not be enough to meet your utility bills every month. You can try to negotiate to save money. It’s much easier to negotiate before moving in than trying to do so after. Here are some things you can do before your move.

Shop Around

To negotiate, you will need to know the possibilities by researching the competing service providers. This is the reason why you need to do your research beforehand. If they are not willing to offer a discount, you can always move to the next best offer because you have several of them down your sleeve.

Change Suppliers

In states that have an “energy choice,” you can negotiate the cost of utilities like electricity and gas. The arrangement allows you to switch to an energy supplier that offers you the best rates.

Other Considerations

In addition to the basic average cost of utilities, you need to consider the area you are moving to and how it will affect your cost of living.

For instance:

Renter’s Costs

Do you know the average rent of an apartment or home where you plan to move? Is what you are being offered considered typical for the area? You will also need to find out if there are laws in the state you are moving to that can protect you from a future landlord raising the rent on your home or apartment unreasonably.

Transportation Costs

Is there convenient public transportation? Or will you need to buy or lease a car to get to work or school? Find out if you can get a monthly pass for public transportation which is typically cheaper than paying per ride. If you plan on owning a car, find out if you will have to pay for a parking spot or if one will be included in your new home. Gas prices can also vary from state to state.

Food

Food prices can vary widely throughout the country. For instance, food costs in New York City are going to be dramatically different from food costs in Texas. Knowing where you will get your weekly groceries is a huge part of your monthly budget. Will you have to drive to a grocery store or is there one nearby that is walkable? Check out the local grocery store where you plan on moving. Do they have everything you need in stock and are their prices within your budget?

Income Tax and Sales Tax

Before you move, know ahead of time what your state is going to charge you for income tax. This can also vary widely from state to state. If you’re moving to California, expect to pay some of the highest income taxes in the nation. While if you’re moving to states like Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, you will pay no state income tax at all!

Sales tax also varies from state to state, so be sure to find out what you will be paying for basic cost of living items like clothing, furniture and so on.

Healthcare Costs

If you are relocating for a job, is healthcare included in your benefits package? If not, what does the state offer by way of healthcare? Some states will also penalize you for not having healthcare, so it’s important to know ahead of time. Other things to consider, walk in clinic availability and cost as well as nearby pharmacies in the neighborhood you are moving to.

If you’re planning a move, check out our moving cost calculator for some help with getting everything where it needs to go.

Not what you were looking for?

Check out other categories that can help you find the information you need!