Can You Deduct Moving Expenses?

Quick answer: No. In most cases, moving expenses aren’t tax deductible. Unless you’re a qualifying military member, moving-related expenses haven’t been eligible for tax deductions since the 2017 Tax Cuts and Jobs Act.

Moving tax deductions were a great way for many people to reduce their move costs by hundreds if not thousands of dollars, but 2017 tax reforms all but eliminated moving tax deductions for the majority of people.

Read on to learn what changes were made to moving tax deductions and see how you can still save money on moving expenses.

How Did the Moving Tax Deduction Work Before Tax Reform?

Before 2018, if you were moving for work, the IRS allowed you to deduct all expenses that were necessary in order for you to move. You had to meet a few requirements that proved the move was work-related:

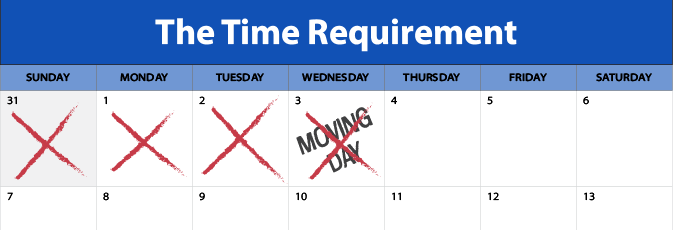

- The time requirement: You had to be working full-time at a new job for at least 39 weeks within the first year after your move date.

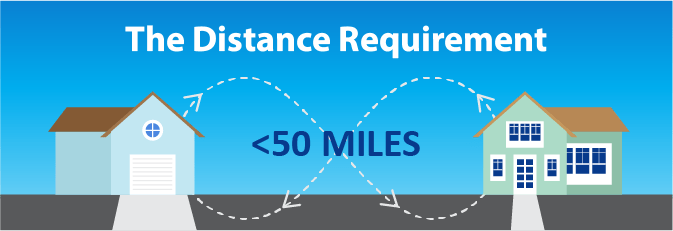

- The distance requirement: The commute from your old home to your new job had to be at least 50 miles longer than from your old home to your old job.

By meeting both requirements, you could prove to the IRS that your move was necessary because of work. You could then deduct any necessary expenses related to the move, including:

- The cost of renting a moving truck or hiring a moving company

- The cost of moving supplies like boxes, blankets, and furniture pads

- The cost of insuring your belongings for a move

- The cost of moving your car

- The cost of storing your belongings if you couldn’t move into a new home immediately

- The cost of temporary lodging during the move

- The cost of gas, tolls, parking permits, and other transportation-related needs

How the Tax Cuts and Jobs Act of 2017 Affected Moving Deductions

The Act passed in 2017 and came into effect in 2018. Among a ton of tax reforms, it suspended the moving tax deduction for most people. That means that most people’s moving expenses are no longer tax-deductible.

The exception is if you’re an active military member moving because of a military relocation. In that case, your moving costs are still deductible. For anyone else, the moving tax deduction is effectively dead.

What’s worse, if your employer pays any part of the relocation cost, that money counts as taxable income. Instead of seeing their tax bill go down because of a move, many people now have to pay more taxes if they move for work.

Are Any Moving Expense Deductions Still Available?

If you’re an active military member and you’re being relocated, your moving expenses are still tax-deductible, and you can include them on Form 3903 with the IRS. Otherwise, if you moved before 2018, your moving expenses may still be tax-deductible, as long as you meet the time and distance requirements.

You’re also exempt from the time requirement if you’re laid off for any reason other than misconduct, or if you can’t work the required 39 weeks within the first year after your move due to a disability.

One other exemption exists. If you moved back to the U.S. from overseas to retire in 2017 or before, you don’t have to work at a new job to claim moving expenses.

For people who have moved since the law went into effect, tax deductions may still apply to state taxes. To find out if your moving expenses are deductible on your state taxes, check your state’s tax codes.

Without Tax Deductions, How Can You Save Money on Your Move?

Here’s how you save on your move without any tax deductions (and maybe save even more than you would have before the Tax Cuts and Jobs Act).

- Do it yourself: By renting a moving truck, packing, and doing the loading and unloading, you can save a ton. If you can’t drive a moving truck, look into containers and freight services.

- Shop around: Get quotes from as many companies as possible, including truck rentals, brokers, container companies, and interstate movers. Get detailed quotes and know what’s included in the price, so there are no surprise costs later.

- Try to score free moving supplies: Many stores will give you free cardboard boxes, and you can check Craigslist for people who just moved and are trying to offload their moving supplies. Check out our guide on where to find free moving boxes.

- Schedule your move for the off-season: Spring and summer are peak moving times. So are weekends, which drives up demand and costs. Avoid those increased costs by moving during fall or winter, and mid-week or mid-month.

- Try to move less stuff: The more belongings you have, the more expensive it’ll be to move them. So instead of packing up everything you own to take to your new home, sell or donate some stuff.

- Negotiate with your new employer: If you’re relocating for a job, negotiate reimbursements for moving costs with your new employer. Keep in mind though, that under the Tax Cuts and Jobs Act, this money will count as taxable income.

What’s the First Step to Saving Money Now That the Moving Tax Deduction Is Dead?

If you’re planning to move you can still save money. The first thing you should do is get a rough idea of what your move might cost across as many companies as possible. Compare cost estimates from multiple movers you can trust with MoveBuddha.

Not what you were looking for?

Check out other categories that can help you find the information you need!