Fewer Flocks to More Frontiers: The 2024-2025 moveBuddha Migration Report

Our analysis of moving patterns in 2024 and predictions for 2025 reveals a slowing of move interest and a growing range of popular destinations. This year, Americans are looking to move to great-value small cities in the South and Mountain West, but they’re also exploring more possibilities nationwide than in recent years.

New moveBuddha Migration Report Reveals Where People Moved in 2024 and Where They Are Headed in 2025

While South Carolina is still America’s favorite move destination, as in 2023, this year, our move preferences are expanding to include a broader range of cities across the region.

In our 4th annual migration report, we look back on the past year and analyze half a million searches made in our moving cost estimator tool.

Unlike Census data, which is often months or a year old, this data is forward-looking and indicates where people are planning to move, how large their moves are, when they’re moving, and where they are moving from. From this, we analyze high-level insights at the state and city levels, using meaningful data patterns.

Here’s what we found in 2024 and what that suggests for 2025 and beyond.

Key Findings Section

- Moving interest has leveled out. Americans aren’t flocking to the same handful of cities with the same intensity as in previous years, allowing for a wider range of locations to see a steadily increasing flow of newcomers.

- South Carolina is the most popular move-to state, with 2.05 in-moves for every move outbound.

- Wyoming is 2024’s breakout state; its popularity has soared 30% over last year.

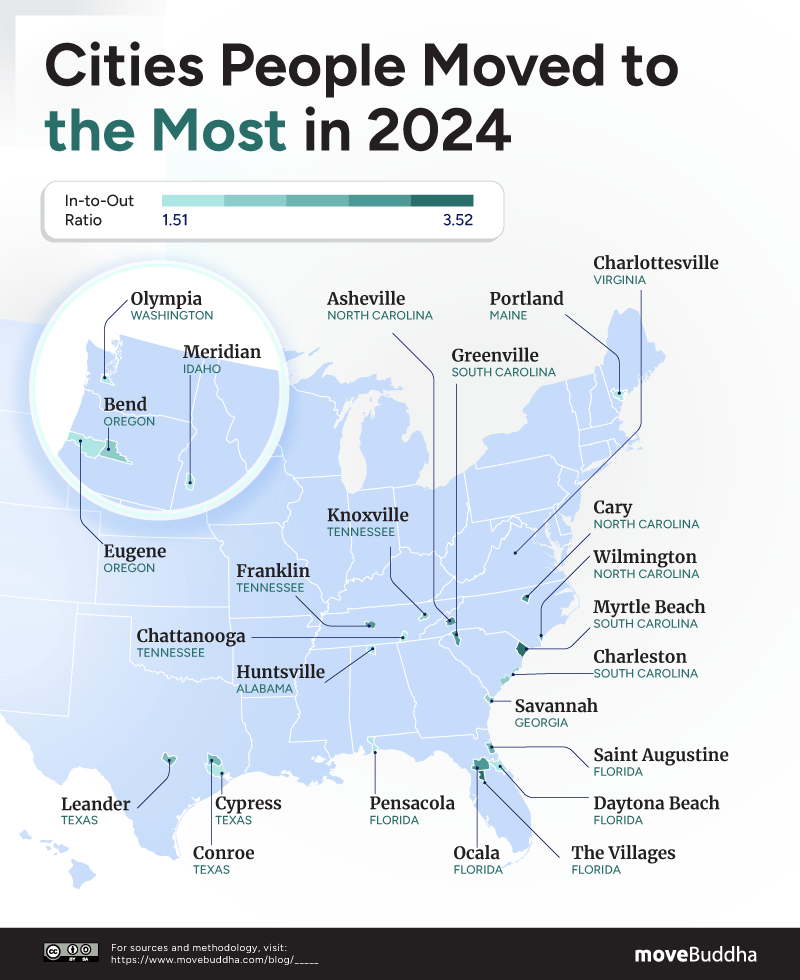

- The Villages, FL, Myrtle Beach, SC, and Ocala, FL, are this year’s most popular in-move cities. The Villages sees 3.52 searches for moves in for every out.

- Raleigh, NC, and Boise, ID, are the top move-to metros per capita.

I. Which states were most popular to move to in 2024, and what changed this year?

II. Which states were increasingly popular to move to in 2024 than the year before?

III. Which cities were the most popular to move to in 2024?

IV. Which metros are earning the highest volume of net searches in 2024?

Methodology

I. More States are Grabbing a Slice of the Migration Pie in 2024

Since 2020, the general theme of U.S. migration patterns has been an accelerated shift to the South and Mountain West, alongside an exodus from high-cost areas in California and the Northeast.

Many of these themes continue in 2024: moving trends show continued movement toward affordability and quality of life, favoring states known for low home prices, less tax burden, and sunbelt climates. To be sure, these trends aren’t absolute. For example, California continues to lose residents despite mild winters, while the Midwest’s affordability hasn’t yet made it more popular with movers.

However, massively populated states like Florida and Texas, which boomed in popularity during and immediately following the pandemic, while still seeing inflow, have seen interest cool as their populations and costs rise. Instead, a greater number of Southern and Mountain West states are stepping up to welcome new movers.

Americans looking to move in 2024 want to go to states like South Carolina, North Carolina, Maine, and Tennessee (more than residents in those states want to leave).

In 2024, here are the states that saw the highest proportion of searches for moves-in, as well as those which saw the opposite:

| States with the highest ratio of moves in-to-out | States with the lowest ratio of moves in-to-out |

| South Carolina — 205 in to 100 out | California — 48 in to 100 out |

| North Carolina — 173 in to 100 out | New Jersey — 63 in to 100 out |

| Maine — 162 in to 100 out | Rhode Island — 65 in to 100 out |

| Tennessee — 160 in to 100 out | Connecticut — 70 in to 100 out |

| Idaho — 159 in to 100 out | Massachusetts — 80 in to 100 out |

| Arkansas — 158 in to 100 out | Illinois — 80 in to 100 out |

| Wyoming — 155 in to 100 out | North Dakota — 82 in to 100 out |

| West Virginia — 152 in to 100 out | Maryland — 82 in to 100 out |

| South Dakota — 146 in to 100 out | Nebraska — 83 in to 100 out |

| Alaska — 136 in to 100 out | Louisiana — 88 in to 100 out |

Of the top ten move-to state destinations this year, just 3 (Idaho, Maine, Alaska) will cost newcomers more than the national average for housing (~$359k, Zillow, Oct 2024).

While the cost of living in the rest of the top move-to states is relatively low on average, increased popularity eventually leads to higher prices.

Since 2023, South Carolina has dominated interstate move searches. This year there are 2.05 newcomers looking to move to the Palmetto state for every resident seeking an exit. While slightly less than last year’s ratio of 2.11 in-moves for every exit, 2024 marks the second year in a row where South Carolina has ranked as the top move-to state.

Migration momentum slows

South Carolina’s slight decline reflects a general cooling of interest in interstate moves nationwide. So while South Carolina’s popularity is only marginally lower this year, other states also show similar or more significantly muted interest than in previous years. And the top exit states? For the most part, they’re experiencing gentler outflow, too.

In 2020, the outbound leaning states had a first quartile ratio of 0.80, which increased to 0.93 by 2024, indicating slower outflow. The inbound leaning states in-to-out move ratio decreased from 1.60 in 2020 to 1.29 in 2024, signaling reduced inflow extremes.

Among all states, the median in-to-out move ratio has seen slight shifts, but it’s the average ratio that has clearly declined from 1.28 in 2020 to 1.13 in 2024. But to be sure, this dwindling in moving interest only indicates a slowing in the growth of top move-to states, not a reversal.

In fact, many states with more than a 40-point reduction of move-in interest (and as much as a 239-point reduction) since 2020 are still experiencing positive in-move ratios.

| State | 2020 in-to-out move ratio | 2024 in-to-out move ratio | Ratio change from 2020-2024 |

| Montana | 3.72 | 1.33 | -2.39 |

| South Dakota | 3.21 | 1.46 | -1.75 |

| Idaho | 3.20 | 1.59 | -1.61 |

| Maine | 2.57 | 1.62 | -0.95 |

| Colorado | 1.59 | 1.09 | -0.50 |

| Florida | 1.67 | 1.18 | -0.49 |

| Arizona | 1.50 | 1.06 | -0.44 |

| Texas | 1.60 | 1.19 | -0.41 |

Other states are starting to see their fortunes change in 2024

While interest dwindles in the most popular moving destinations of the pandemic era, more newcomers are choosing these once off-the-beaten track states, making their in-to-out ratios positive in 2024.

| State | 2020 in-to-out move ratio | 2024 in-to-out move ratio | Change |

| Minnesota | 0.79 | 1.12 | 0.41 |

| West Virginia | 0.81 | 1.52 | 1.26 |

| Michigan | 0.81 | 1.07 | 1.01 |

| Mississippi | 0.85 | 1.12 | 0.93 |

| Kentucky | 0.98 | 1.15 | 0.88 |

How has your state fared?

Most states have found equilibrium following the dizzying extremes of American migration amid the COVID-19 pandemic. Still, some states continue to see high levels of interest in moves-in or -out that will dramatically impact their demographics for years to come.

For example, even though South Carolina’s in-to-out ratio has declined slightly since last year, the state still sees more than twice as many in-moves as out-, and could welcome around 194,313 new residents in 2024. This is assuming that 2024’s actual moves align with search interest as reliably as they did in 2023.

For the least popular move-to state, California, 2024 marked its lowest in-to-out ratio since we began tracking this metric in 2020. With just 48 searches for moves to California for every 100 searches for moves out, even more residents bid goodbye to the Golden State this year. With last year’s 0.53 in-to-out ratio and a net domestic migration loss of 268,052, the state is projected to lose another 296,568 residents in 2024.

II. Who’s Gaining in Popularity: Comparing Interstate Moves from 2023 to 2024

While the South has dominated the move-to landscape over the past few years, not a single southern state ranks in the top 10 for the biggest increase in popularity since last year.

It's Wyoming with a 30% surge of interest in moves from out of state that stands out with the highest percent point increase in the ratio of in-moves to out-moves between this year and last. Why? Following the trend to affordable destinations, homes in Wyoming remain much more affordable than in surrounding states and are even shy of the average home value in the United States.

How we did it: We took the in-to-out ratios from 2023 and 2024 and found the percentage point change in ratio from year to year.

Wyoming Example:

2023 in-to-out ratio: 1.25

2024 in-to-out ratio: 1.55

Ratio change from year to year: 1.25 - 1.55 = +0.30

0.30 x 100 = +30% percentage point difference from 2023 to 2024

Related: Best Interstate Moving Companies

Quiet states see increased interest

Previously sleepy states, such as Wyoming, Alabama, and Minnesota are seeing a gradual uptick in interest.

These relatively modest increases mirror the conservative nature of state-to-state move trends this year (last year’s top state saw interest in moves spike 60% year over year vs. 30% in this year’s top state).

While Wyoming has seen consistent influx since 2020 (when its move ratio was even higher than in 2024, at 1.78). With home costs lower than other Mountain West neighbors like Idaho, Montana, or Colorado, its popularity continues to grow. And while the promise of affordability hasn’t been the rule everywhere, as in notoriously pricy ski towns, Wyoming continues to offer good bargains, wide open spaces, and natural wonders that entice newcomers to “relocate for a life of adventure.”

In keeping with the trend toward more modest gains for more diverse states, some states that have consistently lost residents since 2020 are starting to see increased interest. Take Ohio, Kansas, and Iowa. These heartland states haven’t seen a positive in-to-out move ratio in years, but if interest continues to grow at this year’s rate, 2025 could be the year they start to attract more new residents than they lose.

States popular amidst pandemic see interest level off in 2024

While sleeper states start to gain steam in 2024, interest is waning for destinations that experienced strong growth (and ensuing cost increases) during and immediately after the pandemic. States like Alaska, Colorado, and Montana, while still attracting more residents than they lose, have all seen interest decline this year.

Montana, which saw a whopping 3.72 in-to-out move ratio in 2020, has experienced the biggest slide in popularity. While it’s still gaining 1.33 new residents for each one that moves out, that’s a far cry from the 3.72 in-to-out ratio it saw during the height of the pandemic. The loss in interest comes alongside the skyrocketing housing costs: the price of the average home in Montana has risen nearly 48% since March 2020.

Among the 10 states losing the most interest this year, moves into 6 of these states still outnumber moves out: Montana, Alaska, West Virginia, Oklahoma, Florida, and South Carolina. That suggests that many states experienced a popularity spike that’s falling fast, even as inflow remains positive.

While South Carolina has seen a drop in its in-to-out ratio since last year, its search interest is still the highest of any state, with more than twice the number of people looking to move in for every one heading out.

Other states like North Dakota, Vermont, and Rhode Island were already known for high outflow, showing that interest in moving from these states remains high. These states consistently see more residents leaving than arriving, continuing a years-long trend of outmigration.

III. Which Cities are Attracting the Most Newcomers (and Which are People Fleeing?)

We looked at moving data for all U.S. cities with a minimum of 100 inbound and outbound queries this year to see which cities are seeing droves of new moves. Are these cities responsible for their state’s increasing popularity (or waning affection)?

Of the 280 cities on our list, which saw the greatest increases in mover interest in 2024? And which cities are prospective movers most interested in leaving?

Retirement havens continue to see the highest inflow

The Villages, Florida’s sprawling planned retirement community, where 82% of residents are over the age of 65, gets most of its new residents via out-of-state moves. With 3.52 times more searchers looking to move in than move out, it makes sense that this community of over 150,000 residents is America’s most popular moving destination in 2024.

Now boasting a larger population than cities like Salem, Oregon, or Cedar Rapids, Iowa, the Villages’ growth reflects an ongoing departure of baby boomers from the workforce. Other top-ranked cities like #2 Myrtle Beach, SC, and #3 Ocala, FL, also welcome a high proportion of residents over age 65 (with 25% and 23% residents above retirement age, respectively).

#4 Greenville, SC, and #5 Franklin, TN are also noted retirement hotspots. Franklin made Money magazine’s top 10 list in 2022, while Greenville made Travel & Leisure’s list.

Retirement destinations have an edge on the competition: their residents are more likely to have moved from out-of-state and are less likely to move away again. This accounts for why the top 5 cities are all retirement destinations, and why together they comprise the nation’s only cities with more than twice the inflow compared to their outflow.

Mid-size cities gain momentum

What are the most popular cities on the list that aren’t disproportionately elderly? Look to #6 Cary, NC, #16 Charleston, SC, and #20 Eugene, OR.

With similar sunrises and soft sand to Myrtle Beach, Charleston is a larger hub with a more attractive job market and a more balanced population by age. Cary, NC, in North Carolina’s Research Triangle, sports a younger-than-average population, a thriving university and startup community, and outdoor opportunities. Eugene, OR, dominated by the University of Oregon, is a similar destination where study groups and running clubs dominate — and where students can immerse themselves in an outdoor-oriented lifestyle well past graduation.

Commonalities between the three suggest a surge in popularity among mid-size cities with a balance of education, nature, and urban amenities.

The Suburbs lure more movers

When they’re not looking to mid-size cities, movers are eying smaller enclaves near large cities — in other words, suburbs. #5 Franklin, TN, #9 Conroe, TX, #11 Leaner, TX, #19 Meridian, ID, and #21 Cypress, TX all fit the bill. As in Franklin, putting 40 minutes of open highway between new residents and urban amenities can mean the best of both worlds. Newcomers get small-town charm with big-city sports, concerts, and airports within reach.

Even #6 Cary, NC, which we named a mid-size city for its strong local identity, independent economy, and government services, is highly residential. Its tree-lined streets have a low-density suburban feel that blurs the lines between city and suburb.

One thing’s for sure: no matter how you categorize it, movers favor less urban environments, without giving up some of the perks that come with city growth. Both mid-size cities and suburbs offer a sanctuary outside a core urban zone without sacrificing all of the city's benefits.

| Rank | City, ST | Population | Searches for moves in-to-out |

| 1 | The Villages, FL | 81,400 | 352 in to 100 out |

| 2 | Myrtle Beach, SC | 39,697 | 256 in to 100 out |

| 3 | Ocala, FL | 68,426 | 229 in to 100 out |

| 4 | Greenville, SC | 72,824 | 210 in to 100 out |

| 5 | Franklin, TN | 88,558 | 207 in to 100 out |

| 6 | Cary, NC | 180,010 | 190 in to 100 out |

| 7 | Asheville, NC | 95,056 | 189 in to 100 out |

| 8 | St. Augustine, FL | 15,600 | 184 in to 100 out |

| 9 | Conroe, TX | 108,248 | 181 in to 100 out |

| 10 | Wilmington, NC | 122,698 | 179 in to 100 out |

| 11 | Leander, TX | 80,067 | 179 in to 100 out |

| 12 | Charlottesville, VA | 44,983 | 175 in to 100 out |

| 13 | Bend, OR | 104,557 | 171 in to 100 out |

| 14 | Savannah, GA | 147,748 | 167 in to 100 out |

| 15 | Knoxville, TN | 198,162 | 164 in to 100 out |

| 16 | Charleston, SC | 155,369 | 162 in to 100 out |

| 17 | Huntsville, AL | 225,564 | 159 in to 100 out |

| 18 | Olympia, WA | 55,733 | 157 in to 100 out |

| 19 | Meridian, ID | 134,801 | 157 in to 100 out |

| 20 | Eugene, OR | 177,899 | 156 in to 100 out |

| 21 | Cypress, TX | 200,839 | 156 in to 100 out |

| 22 | Portland, ME | 69,104 | 155 in to 100 out |

| 23 | Chattanooga, TN | 187,030 | 154 in to 100 out |

| 24 | Pensacola, FL | 53,724 | 152 in to 100 out |

| 25 | Daytona Beach, FL | 82,485 | 151 in to 100 out |

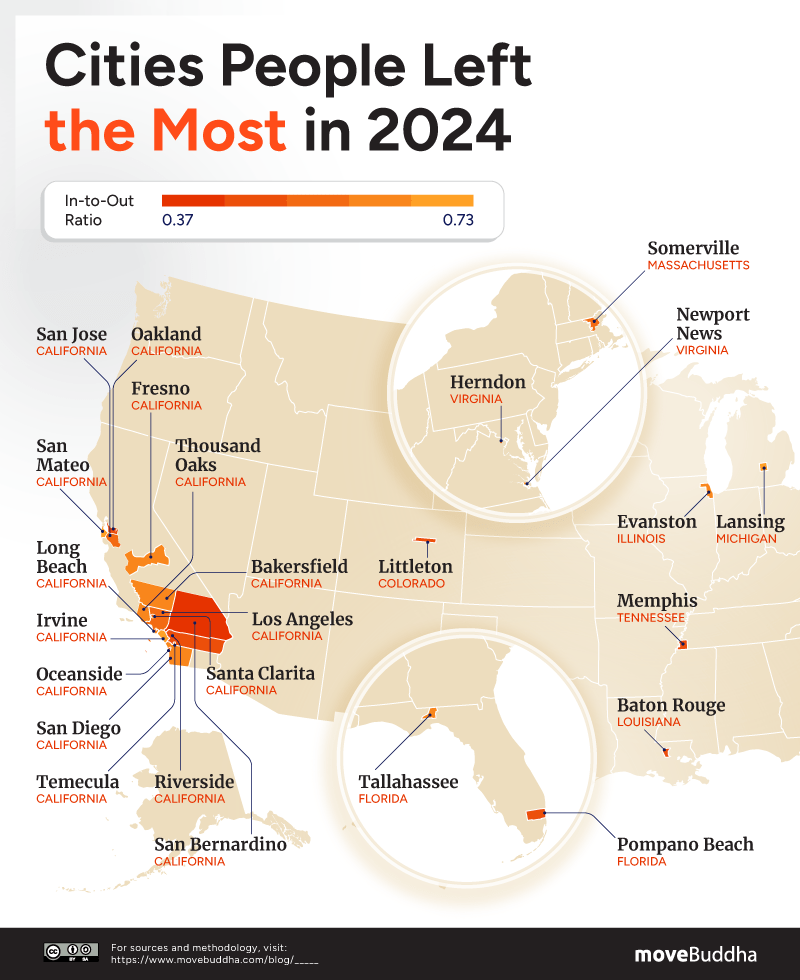

Large urban areas and mid-sized cities with economic challenges see high outflow

California cities like Los Angeles, San Jose, Long Beach, San Diego, and Oakland are known for high housing costs and overall living expenses, which can push residents to more affordable regions.

California dominates the list of cities with the highest outflow, demonstrating that the California exodus isn’t confined to certain cities or regions: it’s impacting the entire state.

While some mid-size cities like Charleston, SC, are gaining steam, those that face economic hardships are seeing outflow.

Cities like Memphis, TN, Baton Rouge, LA, and San Bernardino, CA, all face higher-than-average poverty rates. While the U.S.’s poverty rate is just over 11%, in Baton Rouge, it is as high as 24.02%.

Outflow extends across the U.S

Outside of California, the list of cities with the highest outflows spans multiple regions: there are Southern cities like Baton Rouge and Memphis represented, but also Midwest stalwarts like Evanston, IL, and Lansing, MI. Even the Northeast sees Somerville, MA make the list.

So while California sees many residents wanting to call it quits, it’s not alone. The California experience shows there’s a national search for affordability, opportunity, and a change of lifestyle.

Outliers like small-town Littleton, CO, and Herndon, VA, stand out in a list dominated by larger cities. However, both are adjacent to larger urban areas (Denver and Washington, D.C.), and outflow from these areas could reflect a desire for a more rural atmosphere or smaller metro area.

Tallahassee is another counterintuitive entrant, given Florida’s recent high inflow and the popularity of mid-size cities near universities on the list of top inflow cities. With a younger population, Tallahassee’s outflow may be related to a state or regional inability to retain students after graduation.

| Rank | City, ST | Population | Searches for moves in-to-out |

| 1 | San Bernardino, CA | 223,728 | 37 in to 100 out |

| 2 | Riverside, CA | 318,858 | 52 in to 100 out |

| 3 | Memphis, TN | 618,639 | 57 in to 100 out |

| 4 | Oakland, CA | 436,504 | 58 in to 100 out |

| 5 | Oceanside, CA | 170,020 | 58 in to 100 out |

| 6 | Pompano Beach, FL | 113,619 | 58 in to 100 out |

| 7 | Baton Rouge, LA | 219,573 | 58 in to 100 out |

| 8 | Littleton, CO | 44,451 | 59 in to 100 out |

| 9 | Santa Clarita, CA | 224,028 | 61 in to 100 out |

| 10 | Somerville, MA | 80,407 | 62 in to 100 out |

| 11 | Herndon, VA | 24,935 | 62 in to 100 out |

| 12 | San Jose, CA | 969,655 | 64 in to 100 out |

| 13 | Los Angeles, CA | 3,820,914 | 64 in to 100 out |

| 14 | Long Beach, CA | 449,468 | 66 in to 100 out |

| 15 | Fresno, CA | 545,716 | 66 in to 100 out |

| 16 | Tallahassee, FL | 202,221 | 68 in to 100 out |

| 17 | Thousand Oaks, CA | 123,463 | 68 in to 100 out |

| 18 | San Diego, CA | 1,388,320 | 68 in to 100 out |

| 19 | Bakersfield, CA | 413,381 | 69 in to 100 out |

| 20 | Evanston, IL | 75,070 | 69 in to 100 out |

| 21 | Lansing, MI | 112,115 | 70 in to 100 out |

| 22 | Irvine, CA | 314,621 | 70 in to 100 out |

| 23 | Temecula, CA | 110,682 | 71 in to 100 out |

| 24 | San Mateo, CA | 101,327 | 71 in to 100 out |

| 25 | Newport News, VA | 183,118 | 73 in to 100 out |

IV. Which Metros are Earning the Most Searches Per Capita (and Which are Residents Fleeing)

While some cities dominate in net move interest, normalizing this data for population size and focusing on net inflow into metro areas reveals where interest is truly substantial.

In other words, which metros are seeing the most interest in relocations relative to their population?

By adjusting for population, this data highlights the cities where 2024 migration trends are poised to make the most noticeable impact on neighborhoods.

Smaller metros like Raleigh, NC, and Boise, ID, rise to the top as movers explore less conventional hotspots. Normalizing this data offers a clearer lens on emerging hotspots, too. Places like Huntsville, AL, and Portland, ME, are also attracting high rates of search interest relative to their populations.

Strong local job markets and even remote work may be part of these metros’ popularity in 2024. Raleigh finds itself at the heart of a remote work success story, having benefited from in-moves from remote workers who can choose their home bases outside of work considerations. Commentators credit the temperate weather, low cost of living, and natural and cultural amenities with the rise of Raleigh as a remote work hub. Boise, too, became a remote work destination during the pandemic for employees interested in life in an affordable mountain town.

That small(ish) cities like these continue to top move interest suggests that, despite some return-to-office mandates, enough workers retain the power to work from anywhere, and these are the cities they’re choosing to live in.

By contrast, larger metros like San Francisco, CA, and San Diego, CA, show much higher outbound search interest as housing costs and density continue to drive residents away. Small cities like New Haven, CT, also see interest waning.

Top exit metros

The waning cities are largely a reflection of the post-pandemic migration reality. Cost of living, quality of life, and remote work flexibility have combined to amplify outflow from urban centers, especially in California. Even smaller cities like Modesto or Stockton that once offered a reprieve are losing residents, pointing to a broader desire for affordability and opportunity outside the state.

Just two cities outside California are top exit metros: New Haven, CT, has struggled with economic growth despite being home to Yale — the city’s 25% poverty rate is more than double the state’s average. Memphis, TN, is another struggling metro. Current residents seek opportunities elsewhere, and in-moves are hindered by a lack of appealing amenities, even for remote workers who come without considering the local job market. Ultimately, both cities have seen some of the highest out-move interest in 2024.

Key Summary: Americans Search Less, But in More Places for Their American Dream

Searches are down, as moving itself has stabilized in 2024, reflecting the nation’s recovery from its pandemic moving fever.

But while fewer Americans are looking to move, those who do pull up stakes and head for another state are looking to a wider range of states than they used to.

The gravitational pull that states like Florida and Texas exerted at the beginning of the decade is subsiding. While most of the top states of 2020 remain popular today, none have reached the heights of move interest that the top contenders saw in years past. While South Carolina wins the title for highest move interest in 2024 as it did in 2023, Americans are increasingly finding a more diverse set of destination states and cities.

From Maine to the Carolinas to Idaho and even Alaska, they’re expanding their shortlists of destinations across the nation. Gains in popularity were even seen in many unassuming states like Alabama, Minnesota, Oregon, Utah, and Ohio.

When it comes to cities, retirement havens are indisputably the top performers for way more in-moves than out. But among cities with fewer elderly residents, there’s a trend toward mid-size cities like Charleston, SC, and Eugene, OR.

Notably, metros like Raleigh, NC, and Boise, ID, emerged as per capita leaders in attracting new residents across their urban areas. Strong job markets likely contribute, both cities are home to 2024’s highly coveted move-to suburbs in metros where job growth is higher than the national average.

Overall, migration trends of 2024 show a broad decentralization in Americans’ moving habits. Rather than flocking en masse to a handful of “it” destinations, Americans are instead branching out across a wider range of cities and states, driven by personal priorities like affordability, quality of life, and remote work flexibility.

The era of blockbuster migration hotspots may be behind us. In its place, a more multifaceted landscape is emerging where diverse regions across the country find room to grow in 2025.

Methodology

The data used in this report comes directly from moveBuddha's Moving Cost Calculator.

This analysis takes into account searches made from Jan 1, 2020 through Nov 27, 2024.

Calculations used in this analysis include:

In-to-Out Ratio In-to-Out = Count of Inbound Moves / Count of Outbound Moves

Ratios >1 indicate more inflow than outflow.

Ratios <1 indicate more outflow than inflow.

The in-to-out ratio is the proportion of inbound vs. outbound moves for a city or state over the course of a calendar year.

Ex: South Carolina in 2023 had a net migration ratio of 2.11 (also expressed as 211) meaning that for every 211 searches for moves in, 100 were searching to move out. In 2024 that ratio decreased to 2.05 (also expressed as 205) meaning that for every 205 inbound move searches, 100 were searching to move out.

Ratio percentage point change: Year-over-year in-to-out ratio percentage point change

Percentage Point Change in Ratio = (In-to-Out Ratio 2024 - In-to-Out Ratio 2023) x 100

Calculations based on year-to-year percentage point change in migration were derived using the state migration ratio. This same method has also been used by LinkedIn data scientists and Bloomberg.

A YoY percent point change >0 indicates that there was an increase in the ratio of inflow from one year to the next.

A YoY percent point change <0 indicates that there was a decrease in the ratio of inflow from one year to the next.

Net move interest per capita:

Net inflow (inflow minus outflow) divided by the state population, x 100,000.